TurboTax Home Business 2017 for Mac is the proper software program for accounting and tax accounting. Lastly TurboTax Home Business 2017 Mac is designed by Intuit and designed for accounting and tax administration of small enterprise techniques. In Addition TurboTax Home Business 2017 Mac is for Home windows working system and consists of virtually all of the elements required for small enterprise accounting. The benefit of TurboTax Home Business 2017 is to mix accounting and tax issues collectively, which has led many tax calculations to be completed robotically by TurboTax Home Business 2017. state of affairs. TurboTax Home Business 2017 is very versatile.

You may also choose TurboTax Deluxe 2017 for Mac.

When you consider all that extra security, the prices won't scare you away either. What's more, the data is encrypted by the 256-bit AES protocol, with multiple forms of protection in place to ensure the bad guys don't get in no matter how persistent.  If someone tries to tamper with your iStorage drive, you can configure it to self-desturct.

If someone tries to tamper with your iStorage drive, you can configure it to self-desturct.

Within the settings part, you may Additionally change all elements of the applying in accordance with your corporation. TurboTax Home Business 2017 shops the historical past of installments, dates, taxes, and extra, and alerts you in due time to remind you. One of the vital elements of every accounting and monetary program is its experiences. TurboTax Home Business 2017 additionally has various and intensive experiences. You may Additionally report any saved data that’s specified by the group.All experiences are outputable in a wide range of codecs, and are additionally appropriate for printing on paper.

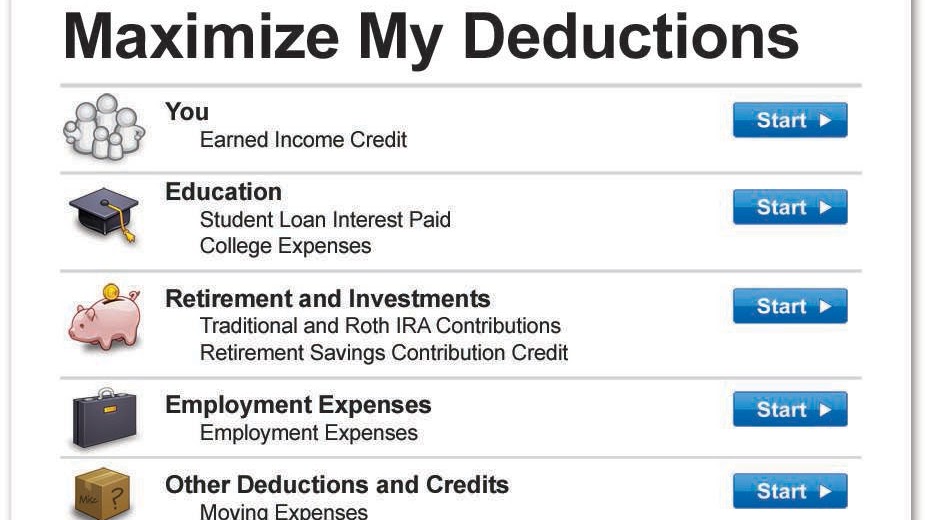

Get your taxes done right with TurboTax 2018. TurboTax is tailored to your unique situation-it will search for the deductions and credits you deserve so youre confident youll get your maximum refund. TurboTax Home and Business Personal and self employed taxes done right Extra guidance for self employment and business deductions Expert answers to tax questions by phone Double checks your return. TurboTax Business is only designed for use on Windows computers; it will not run on a Mac. It is only available as a desktop software program, so no, you cannot use it online. There are not any plans to produce it for a Mac. Share 'Download TurboTax Home & Business 2018 Tax Software Online For Windows And MAC' on Google Plus Pin 'Download TurboTax Home & Business 2018 Tax Software Online For Windows And MAC' on Pinterest Share 'Download TurboTax Home & Business 2018 Tax Software Online For Windows And MAC' on LinkedIn. Buy TurboTax Home & Business Tax Software 2017 Fed+Efile+State MAC Download Amazon Exclusive: Read 161 Software Reviews - Amazon.com.

Features of TurboTax Home Business 2017 for Mac

Find many great new & used options and get the best deals for TurboTax Turbo Tax Home & Business Fed + State 2012 - Upgrade for PC, Mac - 420458 at the best online prices at. Jun 25, 2019 The 2018 Turbotax Home and Business edition is available in CD/download options to file a personal tax return including Schedule C and Schedule SE. The download version is available for both Mac and Windows. It costs $109.99 as of 2018, and this includes one state return and free federal e-file. Turbotax 2018 Federal + Fed eFile - DOWNLOAD - No disc will be shipped. Each purchase will include a download for Windows/PC only - Not available for MAC. TurboTax Business works best if your small business is a partnership, S Corp, C Corp, multi-member LLC, or for trusts and estates; Prepare and file your business or trust taxes with confidence.

Among the features of TurboTax Home Business 2017 for Mac are:

- Mix Accounting And Tax Issues Collectively.

- Additionally Capability To Report Any Saved Data.

- Required For Small Enterprise Accounting.

Technical Details of TurboTax Home Business 2017 for Mac

Check out the technical particulars of TurboTax Home Business 2017 for Mac earlier than downloading it.

- File Name: TurboTax_2017_Home_Business_macOS.rar

- File Size: 221 MB

- Developer: TurboTax

System Requirements of TurboTax Home Business 2017 for Mac

Earlier than you download TurboTax Home Business 2017 for Mac, guarantee that your system meets the given necessities.

- Operating System/OS: Mac OS®X At Least v10.9 or higher (64-bit required)

- Memory (RAM): 2 GB of RAM required

- Hard Disk Space/HDD: 2 GB of free space required

- Processor/CPU: Core2duo or AMD equivalent with SSE2 technology or better

Download TurboTax Home Business 2017 for Mac Offline Setup File

Click on on the below link to download the standalone offline setup of latest TurboTax Home Business 2017 for Mac for Home windows x86 and x64 structure.

Turbotax Business Mac Download

Related Posts:

Turbotax Business Cd Mac

| Other Tax Forms and Schedules | |

|---|---|

| Form 982 | Reduction of Tax Attributes Due to Discharge of Indebtedness |

| Form 1040-ES | Estimated Tax for Individuals |

| Form 1040-V | Payment Vouchers |

| Form 1040X | Amended U.S. Individual Income Tax Return |

| Form 1095-A | Health Insurance Marketplace Statement |

| Form 1095-B | Health Coverage |

| Form 1095-C | Employer-Provided Health Insurance Offer and Coverage |

| Form 1098 | Mortgage Interest Statement |

| Form 1098-C | Contributions of Motor Vehicles, Boats and Airplanes |

| Form 1098-E | Student Loan Interest Statement |

| Form 1098-T | Tuition Statement |

| Form 1099-A | Acquisition or Abandonment of Secured Property |

| Form 1099-B | Proceeds from Broker Transactions |

| Form 1099-C | Cancellation of Debt |

| Form 1099-DIV | Dividends and Distributions |

| Form 1099-G | Certain Government Payments |

| Form 1099-INT | Interest Income |

| Form 1099-K | Payment Card and Third Party Network Transactions |

| Form 1099-MISC | Miscellaneous Income |

| Form 1099-OID | Original Issue Discount |

| Form 1099-Q | Payments From Qualified Education Programs |

| Form 1099-R | Distributions From Pensions, Annuities, Retirement, etc. |

| Form 1099-SA | Distributions from an HSA, Archer MSA, or Medicare Advantage MSA |

| Form 1116/AMT | AMT Foreign Tax Credit/Foreign Tax Credit |

| Form 1310 | Statement of Person Claiming Refund Due a Deceased Taxpayer |

| Form 2106/EZ | Employee Business Exp/EZ Employee Business Expenses Short Form |

| Form 2120 | Multiple Support Declaration |

| Form 2210-F | Underpayment of Estimated Tax by Farmers and Fishermen |

| Form 2210/2210AI | Underpayment of Tax/Annualized Income |

| Form 2439 | Notice to Shareholder of Undistributed Long-Term Capital Gains |

| Form 2441 | Child and Dependent Care Expenses |

| Form 2555 | Foreign Earned Income |

| Form 3115 | Application for Change in Accounting Method |

| Form 3468 | Investment Credit |

| Form 3800 | General Business Credit |

| Form 3903 | Moving Expenses |

| Form 4136 | Credit for Federal Tax Paid on Fuels |

| Form 4137 | Tax on Unreported Tip Income |

| Form 4255 | Recapture of Investment Credit |

| Form 4506 | Request for Copy of Tax Form |

| Form 4562 | Depreciation and Amortization |

| Form 4684 | Casualties and Theft |

| Form 4797 | Sales of Business Property |

| Form 4835 | Farm Rental Income and Expenses |

| Form 4852 | Substitute for Form W-2 or 1099-R |

| Form 4868 | Application for Automatic Extension of Time to File |

| Form 4952/AMT | AMT Investment Interest Expense Deduction/Investment Interest Expense Deduction |

| Form 4972 | Tax on Lump-Sum Distributions |

| Form 5329 | Additional Taxes on Qualified Plans (including IRAs) |

| Form 5405 | First-Time Homebuyer Credit and Repayment of the Credit |

| Form 5695 | Residential Energy Credits |

| Form 6198 | At-Risk Limitations |

| Form 6251 | Alternative Minimum Tax |

| Form 6252 | Installment Sale Income |

| Form 6781 | Gains/Losses from Section 1256 Contracts and Straddles |

| Form 8283 | Non-cash Charitable Contributions |

| Form 8332 | Release of Claim to Exemption for Child of Divorced of Separated Parents |

| Form 8379 | Injured Spouse Allocation |

| Form 8396 | Mortgage Interest Credit |

| Form 8453 | U.S. Individual Income Tax Transmittal for an IRS E-File Return |

| Form 8582/AMT/CR | Passive Activity Loss Limitations/AMT/Credit Limitations |

| Form 8586 | Low-Income Housing Credit |

| Form 8606 | Nondeductible IRAs |

| Form 8615 | Tax for Certain Children who have Unearned Income |

| Form 8801 | Credit for Prior Year Minimum Tax |

| Form 8814 | Parents' Election To Report Child's Interest and Dividends |

| Form 8815 | Exclusion of Interest from Series EE and I U.S. Savings Bonds |

| Form 8822 | Change of Address |

| Form 8824 | Like-Kind Exchange |

| Form 8829 | Expenses for Business Use of Your Home |

| Form 8834 | Qualified Electric Vehicle Credit |

| Form 8839 | Qualified Adoption Expenses |

| Form 8853 | Archer MSAs and Long-Term Care Insurance Contracts |

| Form 8857 | Request for Innocent Spouse Relief |

| Form 8859 | Carryforward of D.C. First-Time Homebuyer Credit |

| Form 8862 | Information to Claim Earned Income Credit After Disallowance |

| Form 8863 | Education Credits |

| Form 8880 | Credit for Qualified Retirement Savings Contributions |

| Form 8881 | Credit for Small Employer Pension Plan Startup Costs |

| Form 8885 | Health Coverage Tax Credit |

| Form 8888 | Direct Deposit of Refund |

| Form 8889 | Health Savings Account |

| Form 8903 | Domestic Production Activities Deduction |

| Form 8910 | Alternative Motor Vehicle Credit |

| Form 8911 | Alternative Fuel Vehicle Refueling Property Credit |

| Form 8917 | Tuition and Fees Deduction |

| Form 8919 | Uncollected Social Security and Medicare Tax on Wages |

| Form 8936 | Qualified Plug-in Electric Drive Motor Vehicle Credit |

| Form 8938 | Statement of Specified Foreign Financial Assets |

| Form 8941 | Credit for Small Employer Health Insurance Premiums |

| Form 8949 | Sales and Other Dispositions of Capital Assets |

| Form 8958 | Allocation of Community Property Amounts |

| Form 8959 | Additional Medicare Tax |

| Form 8960 | Net Investment Income Tax |

| Form 8965 | Health Coverage Exemptions |

| Form 9465 | Installment Agreement Request |

| Form 14039 | Identity Theft Affidavit |

| Form SS-4 | Application for Employer Identification Number |

| Form W-2 | Wages and Tax Statement |

| Form W-2G | Certain Gambling Winnings |

| Form W-4 | Employee's Withholding Allowance Certificate |

| Schedule 8812 | Child Tax Credit |

| Schedule F | Profit or Loss from Farming |

| Schedule H | Household Employment Taxes |

| Schedule J | Income Averaging for Farmers and Fishermen |

| Schedule R | Credit for Elderly or Disabled |

| Schedules K-1 (Form 1041) | Estates and Trusts |

| Schedules K-1 (Form 1065) | Partner's Share of Income, Credits, Deductions |

| Schedules K-1 (Form 1120S) | Shareholder's Share of Income, Credits, etc |